Feature: So, I woke up this morning determined to give something other than WeWork top billing on this blog. However, the ongoing saga gets more absurd by the day and is frankly more interesting than anything going on in the business world right now so WeWork takes the top spot yet again.

Just a few short weeks ago, we were told that WeWork wouldn’t run out of cash until sometime around the end of the first quarter of 2020. LOL, just kidding – they were actually going to run out of cash by the end of THIS WEEK. In fact, things were so dire that the company had to put off laying off employees because they couldn’t afford to pay severances. This is even more stunning when you consider that the company has raised nearly $11 billion during its relatively short lifespan, making it easily one of the most prolific cash burners of all time. As you could imagine, that upped the ante quite a bit to get a rescue package done and SoftBank eventually beat out JP Morgan with the winning bid.

What’s particularly interesting is that Adam Neumann still held all of the cards despite stepping down as CEO earlier this month, due to his controlling shares with 20-1 voting power. As a result, Neumann walked away with a kings ransom and SoftBank got what some might consider a “bad deal” (those quotation marks are the best I could come up with for a sarcasm font). So what does SoftBank’s WeWork bailout look like? I’ll give you a moment to position yourself closer to a toilet, should this make you nauseous. Ok, ready?

This is from the Wall Street Journal (emphasis mine):

WeWork, in danger of running out of cash in the coming weeks, chose a rescue offer from SoftBank over a competing proposal from JPMorgan Chase & Co., according to people familiar with the matter. It had asked both parties to submit proposals by a deadline yesterday.

The deal is expected to value the company at about $8 billion, a far cry from what it was aiming for in an initial public offering earlier this year and even less than the $47 billion at which a January investment from SoftBank pegged its worth.

Mr. Neumann, who was forced out as chief executive after pushback from prospective investors scuttled the IPO, has the right to sell $970 million of shares, or roughly one-third of his stake, in a so-called tender offer in which SoftBank will offer to buy up to $3 billion in WeWork stock from employees and investors.

The Japanese conglomerate, which already owns about a third of the company, will also extend Mr. Neumann credit to help him repay a $500 million loan facility led by JPMorgan, the people said. It will also pay him a $185 million consulting fee. …

As part of the deal, which We was expected to announce as soon as Tuesday, SoftBank would move up a $1.5 billion investment it had been scheduled to make next year and extend the company a $5 billion loan

If I read this correctly, SoftBank is investing $9.5 billion into WeWork which brings their total to around $18.5 billion. This makes perfect sense if you are into lighting money on fire. The part that I find funniest is that they are doing this even though they only value the company at $8 billion (SPOILER ALERT: it isn’t worth anything close to that). In addition, $3 billion dollars goes to bailing out other equity holders – roughly 1/3 of which will go to Neumann – which seems rather absurd. The $185MM consulting fee is vomit inducing but I’m guessing that was the only way to get Neumann to give up the controlling shares necessary to make the deal work. Either way, the buyout seems like a massive waste of cash when equity holders like Neumann could have probably just been diluted rather than limiting the amount going to the company to “only $6 billion.” Also, as a condition to the deal, the company name is being changed to the headline of this blog post.

As you can imagine, employees, many of whom are about to get laid off now that WeWork has the money to pay severances are none too happy that Neumann is walking away from the dumpster fire that he lit and then poured gasoline on (with the help of SoftBank) a billionaire and I can’t blame them one bit. SoftBank probably isn’t thrilled but they were the chief enabler in this mess and as such are ultimately getting their just desserts. Neumann walks away incredibly wealthy despite being one of the most disastrous CEOs in corporate history. As for the company, who knows? I have a sneaking suspicion that this saga is far from over and the way it spends money, the $6 billion should probably last just long enough for Christmas layoffs. So much for elevating the world’s consciousness.

See Also: There is already a WeWork Netflix documentary in the works and frankly, I can’t wait.

Economy

This is Encouraging: Consultancy McKinsey & Co. recently released a survey that found that half of the world’s banks are too weak to survive a downturn due to their returns on equity not keeping pace with costs in a low-rate environment coupled with competition from fintech startups.

Increasingly Uncertain: This excerpt from Oaktree’s Howard Marks’ latest letter perfectly encapsulates how negative interest rates should be viewed:

“At minimum, negative rates mean there’s increased uncertainty, and thus we have to proceed with more trepidation. Whatever we knew in the past about how things worked, I think we know less when rates are negative.”

Doubling Down: China has doubled its planned infrastructure spending in the coming years in order to stave off an economic slowdown amid the trade war.

Commercial

Slow Start: Opportunity Zone funds have raised only 15% of their target on average. A big part of this may be the difficult structure of the capital:

Other challenges are structural. Private-equity funds typically solicit commitments from investors, find deals and then call for money that has been pledged for two years. With opportunity zones, “the money that comes in has to be capital gains,” said Thomas West, a former Treasury official and now a principal at KPMG LLP. “It is very hard for investors to commit to having capital gains on hand over that time period.”

Some managers are already tweaking their strategies. Bridge Investment Group LLC initially aimed to raise a $1 billion blind pool opportunity-zone fund, in which property investments wouldn’t be identified until after fundraising. In June, Bridge switched to a series of smaller funds with investments that have already been identified.

Upping the Ante: Institutions are continuing to raise their real estate allocations in 2019 as the search for yield continues, unabated.

Residential

Imbalance: Affordable housing supply is falling massively short of demand, resulting in a bi-partisan bill to increase the amount of Low Income Housing Tax Credits (LIHTCs) available to developers by 50 percent over a five-year period.

See Ya: There’s an exodus out of California, but its not coming from retirees – who typically have low property taxes thanks to Prop 13 – as typically believed. Instead, its middle class Californians that are streaming out of the state and moving to more affordable markets like Texas, Nevada, Arizona and Boise, Idaho.

Buyers Wanted: Luxury homes for sale in the Hamptons are piling up at a record pace as inventory continues to swell to record levels.

Profiles

House of Mirrors: Brands pay online influencers billions to pitch products. Yet there is still no way to measure sales or verify how many people even see the adds.

20/20 Hindsight: Today we take it for granted as an obvious outcome that Netflix would eventually put Blockbuster out of business. However, this outcome was far from certain when the battle between the two was being waged. See Also: Netflix to sell another $2 billion of junk bonds as it braces for an onslaught of competition. And: Why streaming video will soon look like the bad old days of TV.

Who Could Have Seen This Coming? California’s Assembly Bill 5, which was meant to crack down on companies like Uber and Lyft that use contractors rather than employees is going to have dire consequences for freelance journalists and is setting off an industry shit storm. Of course, it’s being driven by union interests.

Chart of the Day

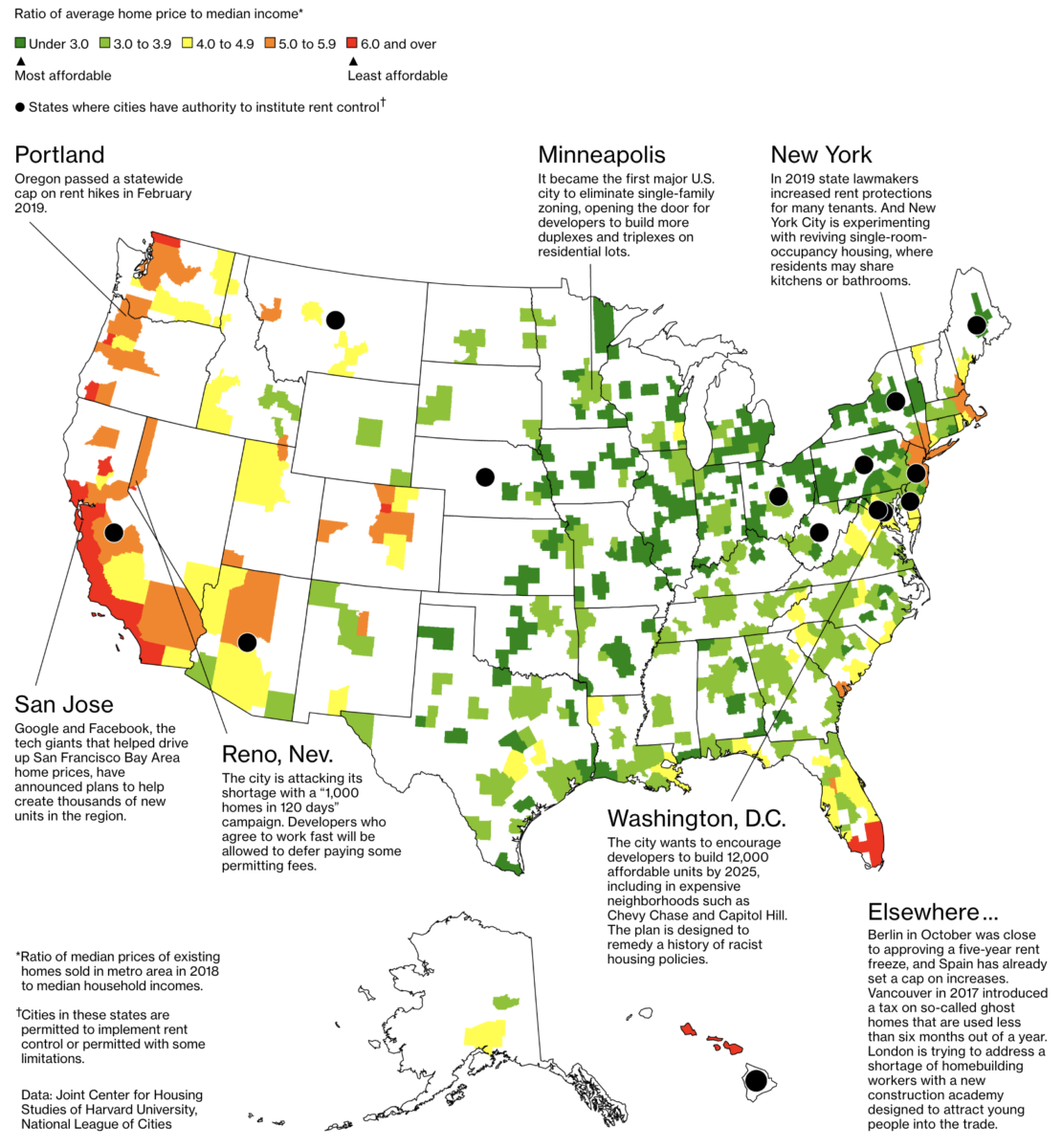

This is a huge problem, especially in California.

Source: Bloomberg

WTF

Get a Room: A man had sex with stuffed animals at Target – including Olaf from the animated Disney movie Frozen – because Florida.

Challenge Accepted: America’s pile of uneaten bacon is the biggest in 48 years.

Oh Really? A group of sex offenders is suing a county sheriff over signs he put up in their yards last Halloween, warning children to stay away. They claim the notices in their yards violated their constitutional rights. I say he’s a hero.

Landmark Links – A candid look at the economy, real estate, and other things sometimes related.

Visit us at Landmarkcapitaladvisors.com