Landmark Links Readers: Thank you so much for following this blog over the past five years. While I won’t be writing here any longer, the site lives on as the new and improved Basis Points Blog. If you’re interested in subscribing, please go to http://www.basispointsblog.com/. Once the site loads, you can enter your email address in the pop up window to subscribe. Be sure to check your spam file if you are not seeing Basis Points in your inbox on weekdays.

Author: Landmark Links

Basis Points September 4th – Hard Stop

What I’m Reading

Hard Stop: The Centers for Disease Control and Prevention is using its quarantine authority to temporarily halt evictions in order to keep COVID-19 from spreading. The order is effective immediately and will run through the end of the year. People earning under $99,000 a year or couples earning less than $198,000 a year are eligible. The sound that you now hear is landlord attorneys furiously typing challenges to this order, which is an unprecedented use of executive authority and will almost definitely be contested. Bisnow

Ripple Effect: Remote work is having a devastating impact on the large service industry ecosystem that relies on office employment and ranges from coffee to airlines. Marker

Penny Pinching: With people going out less and consuming less, coins aren’t making their way through the economy. This is creating major headaches for everything from laundromats to fast food restaurants as change becomes increasingly hard to come by. Washington Post

Shifting: Large cities like New York and San Francisco have been in the headlines lately for falling apartment rents, pushing national averages down. However, secondary markets like Lexington, Knoxville, Phoenix, Nashville and Minneapolis are still quite strong and seeing rent increases over the past year. Globe Street

Grim Milestone: US debt is poised to exceed GDP next year, a first since World War II. Wall Street Journal

Chart of the Day

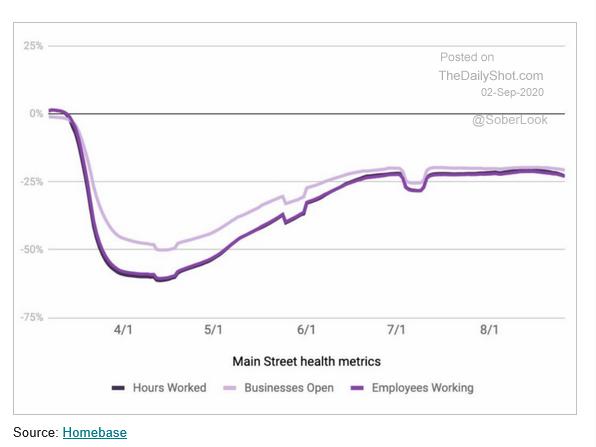

Employment at small businesses has stalled out 20% below pre-COVID levels.

What I’m Reading

Hard Stop: The Centers for Disease Control and Prevention is using its quarantine authority to temporarily halt evictions in order to keep COVID-19 from spreading. The order is effective immediately and will run through the end of the year. People earning under $99,000 a year or couples earning less than $198,000 a year are eligible. The sound that you now hear is landlord attorneys furiously typing challenges to this order, which is an unprecedented use of executive authority and will almost definitely be contested. Bisnow

Ripple Effect: Remote work is having a devastating impact on the large service industry ecosystem that relies on office employment and ranges from coffee to airlines. Marker

Penny Pinching: With people going out less and consuming less, coins aren’t making their way through the economy. This is creating major headaches for everything from laundromats to fast food restaurants as change becomes increasingly hard to come by. Washington Post

Shifting: Large cities like New York and San Francisco have been in the headlines lately for falling apartment rents, pushing national averages down. However, secondary markets like Lexington, Knoxville, Phoenix, Nashville and Minneapolis are still quite strong and seeing rent increases over the past year. Globe Street

Grim Milestone: US debt is poised to exceed GDP next year, a first since World War II. Wall Street Journal

Chart of the Day

Employment at small businesses has stalled out 20% below pre-COVID levels.

Source: @homebase_data

WTF

Kinky: Canada’s chief medical officer is now recommending that people wear masks when having sex. Reuters

Fun Police Win Again: A Kentucky family judge accused of boozing on the job and having threesomes at the courthouse has been kicked off the bench. And, here I thought that this was America. Fox News

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com

Source: @homebase_data

WTF

Kinky: Canada’s chief medical officer is now recommending that people wear masks when having sex. Reuters

Fun Police Win Again: A Kentucky family judge accused of boozing on the job and having threesomes at the courthouse has been kicked off the bench. And, here I thought that this was America. Fox News

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com

Basis Points September 3rd – Stocking Up

What I’m Reading

Stocking Up: US retailers — burned by stock-outs in the second quarter as the retail inventories-to-sales ratio hit a 2020 low in June — are ramping up imports, sending a vast majority of their cargoes through Southern California to feed waves of e-commerce orders to avoid getting stung again by low inventories. This, in turn is putting more pressure on the already stretched warehouse capacity and is yet another reason to be bullish on the space. JOC.com

Picking Up Steam: Proceedings for the eviction of retail tenants are picking up across the country as courts reopen and states’ moratoriums on evictions are expiring or getting curtailed as the economy reopens. Wall Street Journal See Also: Small business failures loom as federal aid dries up. New York Times

Not Getting By: Half of out-of-work Americans were unable to cover basic expenses with money from their unemployment benefits in August as the additional weekly unemployment benefit dropped to $300 from $600. Morning Consult

Incentives: The share of rental listings on Zillow that advertise some form of concession rose from 16.2% in February to 30.4% in July. That includes discounts like free months of rent or parking, offering a gift card, or even waiving a deposit fee. Only 12.5% of rentals advertised concessions last July. Zillow

Up, Up and Away: Amazon moved one step closer to drone delivery after winning FAA approval for their Prime Air fleet. Business Insider

Bag Holders: Wealthy investors who poured money into the EB-5 program to invest in large development projects like Related’s Hudson Yards project in Manhattan are emerging as losers in the pandemic-driven commercial property fallout. Bloomberg Law

Chart of the Day

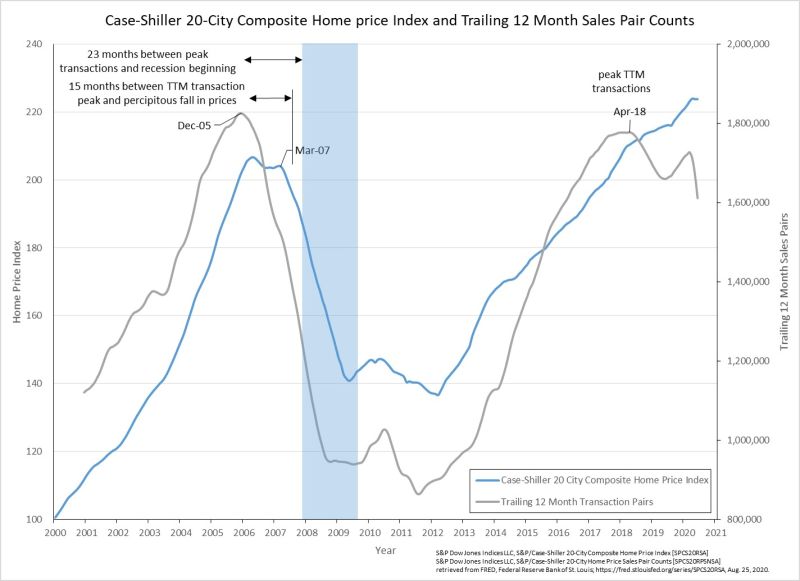

This is an interesting (and contrarian at the moment) chart. If the historical relationship between transactions and price holds, we should see falling home values. However, in the 10 years leading up to 2005, we had 17MM starts with high vacancy while the 10-years leading up to 2018 had only 9MM starts (with a substantially larger population) and low vacancy. Also, the 35-45 age cohort is currently growing but was shrinking in 2005.

Source: @SoberLook

WTF

Ballsy: A Thai tourist is under fire for grabbing a tiger’s testicles for a zoo selfie. If memory serves me right, the last woman who grabbed a Tiger like that was a Perkins waitress. NY Post

Doubling Down: A 19-year-old woman who was arrested after she pulled her pants down and urinated in front of a cop car made matters worse on her way to jail when she allegedly offered to perform a sex act on a patrolman in exchange for her Juul e-cigarette because Florida. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com

Basis Points September 2nd – The Waiting Game

Programming Note: I’ll continue posting here through the end of this week. If you want to sign up to get the new and improved blog in your inbox daily, its easy. Simply go to BasisPointsBlog.com. When you go to the site, a pop up window will appear allowing you to type in your email address.

What I’m Reading

Waiting Game: Although many tenants are not paying rent and many landlords are not paying their mortgages, the floodgates for distressed opportunities have not yet opened, largely because of eviction and foreclosure moratoriums. Deal flow will start once these moratoriums lift and the first shoe to drop will likely be retail. Globe Street

Hitting a Ceiling: High frequency economic indicators like TSA passenger data, restaurant reservations and mass transit volume have mostly plateaued or are declining again. Calculated Risk

Emptied Out: Parking garage operators in NYC operate on month-to-month leases and typically see a decline in occupancy of around 5% in August as residents go on vacation. However this year, occupancy is down as much as 60% in some parts of the city, giving remaining tenants a lot of bargaining power to push back on rental rates. (h/t Mike Deermount) Wall Street Journal See Also: The exodus of New York residents has led to bidding wars on pretty much any available homes in suburban New Jersey, Long Island and Connecticut. New York Times

Danger Zone: In a recent study, Trepp reported that the percentage of loans that are 30 or more days delinquent was 23.4 percent as of July. That’s the highest percentage on record, and an incredible 1,746 percent increase from July 2019, when only 1.34 percent of hotel loans were more than 30 days past due. Mortgage Professional America See Also: Shares of luxury operator Host Hotels fell after the company said it expects the COVID-19 pandemic to have a “material negative impact” on financial results “well after” restrictive measures to contain the outbreak have been lifted. MarketWatch

Discount Dining: The continuing pandemic fallout has LA’s restaurant real estate market seeing a 20% drop in rental rates. Private landlords have been more willing to drop their asking rates to make a deal while institutional owners haven’t budged from their pre-pandemic levels. Eater

Free Fallin’: Zumper’s national August apartment rent report is showing double-digit year-over-year decreases in San Francisco, San Jose, NYC, and DC with no signs of bottoming out. Zumper

Chart of the Day

The blue line below represents Real Capital Analytics’ property price index for NYC commercial buildings. The orange line is the price adjustments necessary today to keep deal volume constant given historical trends in the supply and demand for real estate investments as calculated by the team at the MIT Center for Real Estate Price Dynamics Platform. The relationship between these two is usually quite consistent. Something has to give…

Source: Real Capital Analytics

WTF

Frowned Upon: An Oklahoma man arrested for going through a Taco Bell drive-thru naked told police that all his clothes were in the wash and that he was unaware such nude motoring was illegal. The Smoking Gun

Tis the Season: A 74-year-old landlord shoved a female tenant and then stole a Donald Trump flag that was displayed in the victim’s yard because Florida. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com

Basis Points September 1st – Liftoff

Landmark Links Readers:

Welcome to Basis Points, a daily go-to for the best and most interesting curated commercial and residential real estate stories, combined with original commentary and analysis.

If you are frequent reader of my blog (formerly Landmark Links), you may have picked up on some hints I’ve been dropping about an upcoming big announcement. Today I am thrilled to reveal the official launch of RanchHarbor!

RanchHarbor is an integrated real estate investment firm providing value-driven joint venture equity and GP co-invest equity ($2MM-$15MM), asset management, receivership and capital advisory. The company is a combination of the former Isles Ranch Partners and former leadership of Landmark Real Estate. Get the full story here.

Now to Basis Points. This blog has evolved a lot over the years but perhaps never so much as in the past few months when I made the decision to begin posting five days a week. The objective has always been to provide you with curated articles and original commentary. My daily observations, analysis and rants have meant to serve as guidance in helping readers understand what is going on in the real estate and finance industries a bit clearer, and hopefully make more sound and well-thought-out business decisions.

While considering various blog name options, I wanted to find something that was clever, had meaning and accurately reflected the content. After much thought, it became clear Basis Points was the perfect fit.

According to Investopedia:

“Basis points (BPS) refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.”

In the world of real estate finance, basis points are the foundation upon which deal terms are expressed, returns are reported and promote hurdles are met. But the term holds a dual meaning for me. The information, thoughts and commentary shared on this blog are the “basis points” I refer to in my daily decision making – in business, personal investing and even sometimes when negotiating with my wife.

The content and format of Basis Points will remain the same as what you’re accustomed to seeing on Landmark Links. The blog will retain its focus on curating and briefly summarizing the most interesting real estate, finance, economic, and of course WTF stories every weekday, with occasional original commentary and analysis.

While I am eternally grateful to my partners at Landmark, I’m also excited to start this new chapter with RanchHarbor and Basis Points, especially during this most unique and turbulent of times. There is perhaps more to blog about now more than ever.

I’ll be co-posting on the Landmark links website for the next couple of weeks but will begin migrating all new content to BasisPointsBlog.com. When you visit the new web-page, be sure to enter your email so that you don’t miss a single new edition of Basis Points!

Thank you for your continued followership!

I’ll continue posting here for another week or so but if you want to sign up to get the new and improved blog in your inbox daily, its easy. Simply go to BasisPointsBlog.com. When you go to the site, a pop up window will appear allowing you to type in your email address. Thanks you for being loyal Landmarks Links readers and I hope that you enjoy Basis Points!

What I’m Reading

Backing Out: Pinterest terminated its massive 490,000 square foot lease at San Francisco’s un-built 88 Bluxome project, citing a shift toward more remote work amid the coronavirus pandemic. The company had to pay a one-time fee of $89.5MM to cancel the lease in the speculative office development. San Francisco Chronicle See Also: On the plus side, American commuters have saved nearly $91 billion since COVID work from home began. Bloomberg

Headed in the Wrong Direction: After improving markedly in July, the number of borrowers struggling to make their monthly mortgage payments has essentially flat-lined and now threatens to move higher. Perhaps the most concerning trend, per Black Knight’s latest release is that close to three quarters of those in forbearance have had their terms extended from the initial three-month period. CNBC

Water, Water Everywhere: Banks are full of contradictions at the moment. Profits have tumbled due to swelling loss reserves and margins are at an all-time low. However, fee income is at a historical high and deposits have surged. While the outlook for the economy is bleak, banks are sitting on a pile of cash and currently have nowhere to put it. Wall Street Journal

Staying Power: A surge of US imports driving port activity that began in late June is now projected to last through at least October as consumers continue shopping online for a broad range of merchandise, more than replacing the weakness in in-store purchases due to COVID-19. JOC.com

Misdirection: Earlier this year, lumber mills cut production dramatically to get ahead of the expected fall-out from expected lower housing demand due to COVID. Then housing starts unexpectedly shot up and remodeling surged, sending lumber prices skyrocketing. Disciplined Systematic Global Macro Views

Kicking the Can: Landlord optimism about a retail revenue recovery has resulted in widespread deferred rent as an accommodation to get through the pandemic. However, the actual numbers upon re-opening are not so good and already-low-margin tenants may not be in a position to actually pay back those deferrals in the relatively short time frames often stipulated in deferral agreements. Globe Street

Chart of the Day

This is one really depressing chart.

Source: Visual Capitalist

WTF

Extra Sausage: An Ohio woman called the police because she thought that an oddly-shaped piece of meat that she got from a grocery store was actually a penis. Vice (h/t Jack Jorgensen)

Covidiot of the Day: A Disney worker was struck in the head by a theme park patron who became upset when told that a mask worn by one of his children did not meet safety standards because Florida. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com

Landmark Links August 31st – Storm Clouds

What I’m Reading

Storm Clouds: Loans and leases can only be restructured for so long before they result in defaults, which will in turn trigger litigation. As the COVID-induced recession wears on, it becomes more likely that we will see a wave commercial real estate litigation. However, the courts were largely understaffed before the pandemic and the existing backlog could take a very long time to work thorough.

Shifting Goal Posts: The Federal Reserve approved a major shift in how it sets interest rates by dropping its longstanding practice of preemptively lifting them to head off higher inflation, a move likely to leave U.S. borrowing costs very low for a long time.

Coupon Clipping: The reduction in unemployment benefits is showing up in grocery spending. Data shows that shoppers are cutting back, a sign that Americans are hurting for cash as the federal unemployment stimulus remains on hold for most recipients. Grocery had been one of a handful of strong sectors in the initial outbreak. This also likely bodes poorly for more discretionary sectors as well. See Also: America’s biggest dollar store chains reported better-than-expected quarterly profits, as cash-strapped consumers sought lower priced groceries and household items in a coronavirus-induced economic downturn.

Permanent Residents: People’s realization that they can work from anywhere during Covid-19 office shutdowns have led to bidding wars for homes in remote areas of the West, especially in resort towns like Lake Tahoe and Vail.

Taking Share: New homes account for the biggest share of US sales in 12 years.

Charts of the Day

Even $300 in weekly payments replaces the income of a lot of Americans.

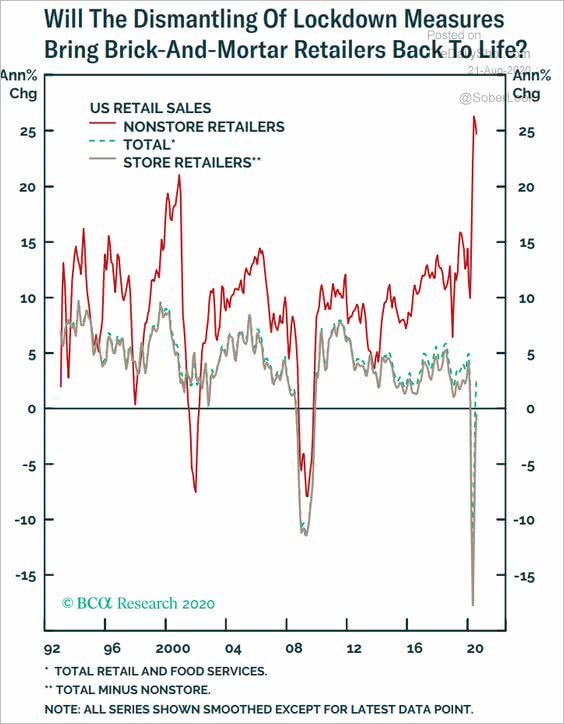

Spending has not fallen off a cliff….Yet.

The lack of clarity as to what will happen next is not a positive.

Source: The Daily Shot

WTF

Caught With His Pants Down: A government official in the Philippines was busted having sex with his secretary during a Zoom meeting when he apparently forgot that the video feature was turned on.

Cruise Control: A motorist admitted that he was watching a movie when his Tesla, which was on auto pilot mode, crashed into a police car. (h/t Ralph Emerson)

Landmark Links – A candid look at the economy, real estate, and other things sometimes related.

Visit us at Landmarklc.com

Landmark Links August 28th – Shrinkage

What I’m Reading

Shrinkage: A newly-released survey by KPMG found that 68% of large company CEOs plan to decrease their office footprint. Six months in to the pandemic, it appears as though office tenants are doing just that, with JP Morgan and Ford – two non-tech giants – recently announcing that employees will be able to work from home at least part-time. See Also: A wave of office space is now hitting the sublease markets in urban cores like San Francisco, New York and Los Angeles. And: Cushman and Wakefield Economist Kevin Thorpe is predicting that the office market is unlikely to recover until late-2022, with asking rents falling 10-15% on a nationwide basis before that. However, Thorpe ultimately sees the sector recovering since a steadily-larger percentage of new jobs being created today are in traditionally office-using industries.

Confidence Game: Consumer confidence indicators are falling as more companies announce layoffs, jobs get harder to find and the coronavirus pandemic continues to wreak havoc on the economy with no additional federal support in sight. See Also: American Airlines announced that it will shrink its workforce by 30% or 19,000 once federal stimulus ends in October, as the pandemic continues to weigh heavily on travel demand.

Playing Both Sides: Some of the largest real estate investors like Brookfield, Colony, Starwood and Blackstone are walking away from debt on bad property deals, even as they raise billions of dollars for new opportunities borne of the pandemic.

Impasse: Several bills intended to streamline housing approvals in notoriously difficult California have hit roadblocks thanks to construction unions – and the politicians that they back – insisting on labor provisions that would likely drive the cost of construction too high to be feasible.

Distressing: More than $54.3 billion in U.S. commercial mortgage backed securities – the vast majority of which are in retail and hospitality – have been transferred to loan workout specialists mostly because of payment delinquencies, a 320% increase since the start of the Covid-19 pandemic, according to Moody’s Investors Service.

Chart of the Day

Bank lending standards have tightened in the US substantially more than they have in other advanced economies.

Source: @ISABELNET_SA, @GoldmanSachs

WTF

Bewitching: A man was arrested for firing gun at a woman who he alleged is a witch, believing she had previously cast a spell on him because Florida.

Is This Thing On? A high school teacher is being investigated for watching porn while his students were logged in to his Zoom class because Florida.

Landmark Links – A candid look at the economy, real estate, and other things sometimes related.

Visit us at Landmarklc.com

Landmark Links August 27th – Pending Surge?

What I’m Reading

Pending Surge? July’s new home sales report of 901,000 annualized is the highest reading since December 2006. It is also in line with peak home sales in all periods prior to the 2000s housing bubble. Housing prices typically lag sales, meaning that an uptick in home price inflation could be right around the corner.

Give it Away Now: Office leasing concessions rose sharply in Q2, according to CBRE, which reports that there was a 6.6%, year-over-year decline in net effective office rent in the 15 largest US markets while net effective rents only declined 1.1% for the same period.

Gotta Hear Both Sides: The inflation (supply of money) versus deflation (lack of velocity) debate is raging again as economists attempt to determine the trajectory of a global economy that has been ravaged by the pandemic, yet boosted by unprecedented monetary and fiscal response.

Only Game in Town: Despite the zoning challenges, manufactured housing offers the only affordable detached housing option in many US markets. See Also: New homes priced at $150k or lower are a category that virtually no longer exists.

Flexible: Retail landlords are beginning to offer ‘pandemic clauses‘ in new leases that allows for deferral of rents or a switch from base rent to participation in gross sale revenue in the event that tenants are not permitted to be fully operational.

Too Little, Too Late? S&P Global analysts Alexander Bitter and Chris Hudgins are warning that bankruptcy alone might not be enough to save some retailers, sending them toward liquidation.

Chart of the Day

Forbearance extensions are on the rise.

Source: Mortgage Bankers Association

WTF

Party Animals: Teenagers broke into a New Jersey petting zoo last weekend, rode on miniature donkeys, and even put lipstick on one of the animals. They were discovered when they put the whole thing on Snapchat and tagged the location.

Get Off: A woman was arrested for beating up her boyfriend after she caught him watching porn on his phone because Florida.

Landmark Links – A candid look at the economy, real estate, and other things sometimes related.

Visit us at Landmarklc.com

Landmark Links August 26th – Big Short Redux

What I’m Reading

Big Short Redux: Some hedge funds have made a killing this year by shorting CMBS series with a high concentration of mall debt.

Downward Trend: NMHC’s Rent Payment Tracker continued its downward trajectory in August, with collections off over 200 basis points from last year. That being said, it still hasn’t yet fallen off a cliff as many of us have feared it would. But See: Smaller landlords are faring worse than the mostly institutional owners included in the NMHC numbers. Nearly a third of renters who live in single-family or small multifamily properties owned by individual landlords were unable to pay their August rent, according to a survey by Avail, a technology and marketing platform for small landlords. That is up from just under 25% in July.

Rolling Over: Real time economic data is beginning to show a pause in our nascent recovery as aid programs expire and the federal government stays deadlocked.

Blown Past: Hotel loan delinquencies backing U.S. commercial mortgage-backed securities are already outpacing late payment levels set during the 2008 Great Recession, new data from Trepp Analytics shows.

Double Edged Sword: If work from home were to come to a sudden end, traffic congestion would likely increase substantially as mass transit has become a far less attractive alternative during the pandemic, turning a former strength of big cities into a weakness.

Resilient: While year-over-year rent growth is down, monthly trends are pointing towards strengthening performance in the self storage space.

Chart of the Day

Source: @SoberLook

WTF

Watered Down: A man in Vacaville, CA defended his house from raging LNU Lightning Complex Fires by spraying cans of Bud Light on it.

She Who Smelt It: A woman was arrested for allegedly battering her father “due to his flatulence” inside their residence because Florida (h/t Aman Lal and Steve Sims)

Landmark Links – A candid look at the economy, real estate, and other things sometimes related.

Visit us at Landmarklc.com

Landmark Links August 25th – Short Term

What I’m Reading

Short Term: The pandemic fallout has accelerated the trend towards shorter term office leases. This will have a negative impact on valuations thanks to the large capital cost associated with re-tenanting space. However, there will be some offset since it will also allow office landlords to raise rents quicker when the economy is strong, rather than being locked in with long term tenants. In addition, shorter lease terms are often done at a rental premium.

Bounce Back: Some companies are beginning to restore cuts they made to managers’ salaries and bonuses in the early days of the pandemic shutdown. But See: The rapid adoption of remote work and automation could accelerate inequalities in place for decades. Economists say the resulting ‘K’ shaped recovery will be good for professionals—and bad for everyone else.

Time to Pivot: COVID-19 came on the heels of a glut of office construction in some markets. As landlords try to figure out what to do with this now-unwanted space, residential conversion is a potential option.

Headed for the Exits: The moving industry is fractured among numerous small business owners, and official statistics are tough to come by. That being said, moving companies in NYC are reporting that demand has been so overwhelming that they are turning down jobs, due to a lack of capacity.

Slow Down: While Fannie Mae is projecting that 2020 could be its best year since 2003, commercial real estate lending is expected to fall 40% this year.

Chart of the Day

I’ve posted some variations of this chart in the past. It really is stunning how poorly San Francisco and NYC are faring versus the rest of the country. The reason that the disparity is so substantial between SF and NYC is that the latter was oversuppled before COVID hit, while the former was not.

Source: JBREC

WTF

Sympathy Play: A candidate in a crowded South Carolina mayoral race is accused of orchestrating an elaborate ruse for sympathy votes using a fake kidnapping and Facebook Live.

Fish in a Barrel: Three men were caught burglarizing nearly 30 homes, wearing GPS ankle monitors while on pretrial release for previous crimes because Florida.

Landmark Links – A candid look at the economy, real estate, and other things sometimes related.

Visit us at Landmarklc.com