Lead Story… Economic mobility has long been a cornerstone of the dynamic American Economy. A big part of economic mobility is the freedom to move, allowing workers to move to more productive regions where better employment is available. However, people are moving less, while economic and demographic conditions indicate that they should be moving more and it could be putting our economic dynamism at risk.

When it comes to housing, conventional wisdom is that, all things being equal, the decision on whether to buy or rent is one of stability versus mobility. If a family owns their home, they build equity as they pay down their mortgage and hopefully benefit from appreciation as well. The home-owning family also benefits by fixing their cost of living at least when it comes to principal and interest payments – taxes, insurance and maintenance are all variable to some extent. Home ownership is inherently stable. You don’t have to worry about rent increasing so much that it becomes un-affordable or having your landlord decide that they no longer want to rent the property for one reason or another. However, this stability comes at a price. Buying and selling a home has a high transaction cost and living in a home that you own can come with significant maintenance costs. Buying a home also typically requires a substantial down payment that eats into savings.

Renting is the opposite. A renter does not pay for maintenance, nor are the transaction costs of renting particularly high. If something breaks, it’s the landlord’s responsibility to fix. Renting should allow for far more mobility than owning. The downside of renting exposure to annual rent increases that can be significant in a tight market or a landlord deciding to sell or take a property off of the market. Renting is not necessarily “better” than owning or vice versa. It all comes down to individual circumstances. The home ownership percentage in the US has been peaked at 69.2% in 2004 and has been falling ever since. It is now down to 63.7%, indicating that the renting population is growing in percentage terms while the owning population is falling.

In fact, it’s not just the growing population of renters that suggests that mobility should be on the rise. There are several other factors as well:

- People are putting off household formation longer. Historically, single people are more likely to move than those who are married and/or have kids.

- We are now several years into an economic expansion which typically increases mobility. In contrast, a bad economy usually means less mobility.

- The unemployment rate is low and falling indicating a tighter labor market. In the past, this has meant that workers are more open to leaving their job for a better opportunity, a decision that often entails moving.

Given the above, it stands to reason that domestic migration (the rate at which people move) should increase in times when the home ownership rate drops and decrease in times when the home ownership rate rises. However, as with so many things in our current housing cycle, this has proven not to be the case. In fact, domestic migration is down substantially. It’s been falling since the 1980s and has continued it’s downward trajectory in the current recovery. The Economist addressed this puzzling trend in a recent story entitled Millennials May Move Less Because Fewer of Them Own Homes (emphasis mine).

MILLENNIALS—the generation which roughly includes those born between 1980 and 1996—have a reputation for being footloose. But analysis by the Pew Research Centre released in February suggests American millennials are moving less than previous generations did when they were younger. In 2016 20% of those aged 25-35 changed addresses, compared with 26% of the generation above in 2000 and 27% of late baby-boomers in 1990. Frequent moving in search of opportunity has long been an ingredient in American exceptionalism. Economists such as Tyler Cowen, author of “The Complacent Class”, worry that its decline will dampen the nation’s dynamism.

Since the 1980s, Americans of all ages have become more rooted. Between 1980 and 1981, 17% of Americans moved house, according to William Frey, a demographer at the Brookings Institution, a think-tank. Between 2015 and 2016 only 11% did. Migration between states, which is often driven by professional choices, has fallen by half since 1990. Young people, who normally move around most, seem especially stuck.

This is strange. More millennials lack the anchors that have previously rooted people in place: they are marrying later, having children later and buying homes at lower rates than previous generations did. In 1990 just under half of 18-to-34-year-olds had never married; that share increased to two-thirds in the period between 2009 and 2013. Less than half of 25-to-35-year-olds had children in 2016, compared with more than half for the previous generation and baby-boomers at a similar age. In 1982 41% of those under 35 owned homes. Today that share has fallen to 35%.

Yet despite the loosening of such ties, both short- and long-distance migration have decreased among 25-to-34-year olds since 1995. Short-distance moves within counties often happen when people simply move house—for example, to accommodate an increasing number of children. The fact that American youngsters are waiting longer before they start families may partly explain the drop in short-distance moves.

People tend to move longer distances, across counties and states, in search of better jobs. The recent recession saw longer-distance migration among young people fall. It has since recovered a bit. One factor that might explain what is going on is the relationship millennials have to home ownership. Aspirations to buy, rather than rent have traditionally pushed a significant share of young Americans to move. According to analysis by the Pew Research Centre, in 2000 14% of Generation Xers (born roughly between 1965 and 1980) surveyed by the Census Bureau said their primary motive for moving was to buy a house. In 2016 only 6% of millennials said the same. That might be partly because childless bachelors and bachelorettes are decreasingly likely to covet grassy yards and white picket fences.

Or perhaps such things are simply out of reach. Median earnings for full-time workers aged 18-34 fell by 9% between 2000 and 2013. In 2014, for the first time, more 18-to-34-year-olds lived with their parents than in any other arrangement, maybe because they could not afford to do otherwise. Conversely, it may be the case that people who already own houses—or equity in a house—are more inclined to move than those who do not.

Mr Frey wonders “whether [millennials] are ushering new young adult tastes and lifestyles that may be mimicked by generations that follow them; or is this a one-time downturn because of their difficult generation-specific economic circumstances?” If it continues, the decline in migration among millennials could spell trouble. Americans become less likely to move as they get older. If they’re staying put now, millennials probably won’t shift for better opportunities later on either.

The Economist piece makes some good points but ignores the elephant in the room: housing supply in cities with strong economies. Let’s use an example: say that a young person in Columbus Ohio who is renting a 1-bedroom apartment wants to move to Los Angeles for a better job opportunity. An average one bedroom apartment in Columbus costs $750 per month. That same one bedroom in LA averages $2,014 per month. This is a major impediment to moving because, not only did your rent just go up by $1,264 per month but that’s in after-tax dollars. Also, rent is not the only expense that is higher than LA than in Columbus. Pretty much every major cost of living item is substantially higher. Bankrate.com has an excellent tool to measure cost of living. According to Bankrate, to replace a $50,000 a year salary in Columbus our hypothetical mover would need to make $77,514 per year. That means that our hypothetical young employee would need to make a whopping 55% higher salary just to break even taking the new job! The median income in Los Angeles is around $55,900, compared with just $44,000 in Columbus. The problem is obvious: while median income in LA is 27% higher than median income in Columbus it doesn’t come close to covering the increase in cost.

LA and other coastal cities are so expensive primarily because not enough housing units are being built to accommodate the people moving there. This is not a recent phenomenon but it has been getting worse in recent years. The resulting high price acts as a barrier to entry to those who would otherwise move to one of these cities for better economic opportunity. In addition, it’s also incredibly difficult to save up to buy a home in a city like LA when you are paying a seemingly ever-increasing amount for rent each month, again resulting in less people moving. When you combine the high cost of living in coastal cities with other negative factors like student debt loads, it’s not hard to see why young people don’t move. It’s not that renting makes someone statistically less likely to more than owning does but rather that they don’t have a choice in today’s expensive and supply constrained coastal cities.

Economy

No Other Way: It’s virtually impossible to deliver meaningful tax relief to people in lower income brackets without addressing the payroll tax.

Moot Point: Curbs on coal may be eased but companies are sticking with their plans to invest in power from natural gas, wind and solar for economic reasons.

Boom Town: Nevada is undergoing a lithium rush as miners seek out the light metal that is the key to powering the new battery-based economy.

Commercial

Buying Spree: China is now the world’s largest source of outbound hotel investment.

Residential

Giant Sucking Sound: Between tight credit and a lack of construction, the sluggish housing market has taken a $300 billion toll on the economy since the recovery began.

Like Clockwork: Interest rates are going up, so of course we are starting to see articles like this one from the Wall Street Journal explaining why buyers should use adjustable rate mortgages and interest only loans again. SMH.

Unintended Consequences: A new report from Trulia found that markets where the housing recovery has been the most substantial also have the biggest inventory shortages. The reason is that people are less inclined to sell their current home if they know it will be hard to find a new one. This also plays in nicely with today’s lead story.

Profiles

Taken to the Cleaners: How Las Vegas made possibly the worst taxpayer giveaway stadium deal of all time with the Raiders. Also, Raiders fans travel well. Home game day Southwest flights from Oakland and LA to Vegas are going to be lit AF in a few years once citizens of the Black Hole start piling in on Sundays.

Up in Smoke: Canada is set to legalize marijuana nationwide in 2018. See Also: States where medical pot is legal see decrease in painkiller abuse.

Never Saw it Coming: How Instagram gave designers a direct (and relatively inexpensive) connection with consumers and killed the retail store in the process.

This Ends in Tears: Chinese crowd funding via smartphone is now a thing and sounds sketchy as hell.

Below the Surface: The Wall Street Journal took a fascinating look at the high speed trading and algorithms behind your Amazon purchase. See Also: Why Amazon is making a big move in the seller receivables financing business.

Chart of the Day

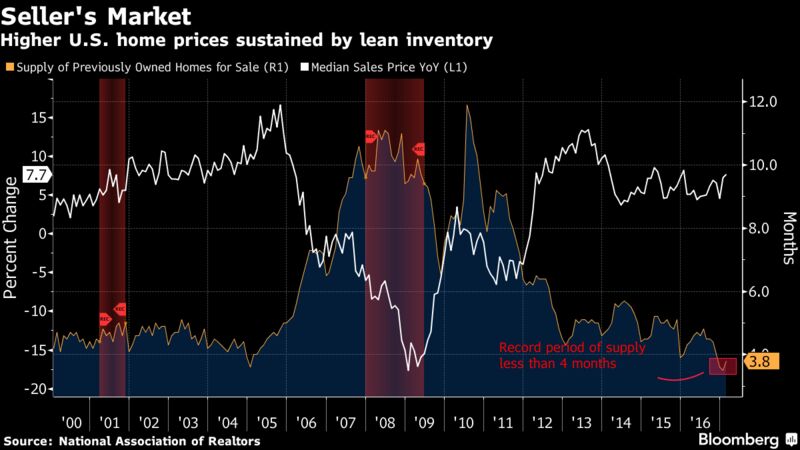

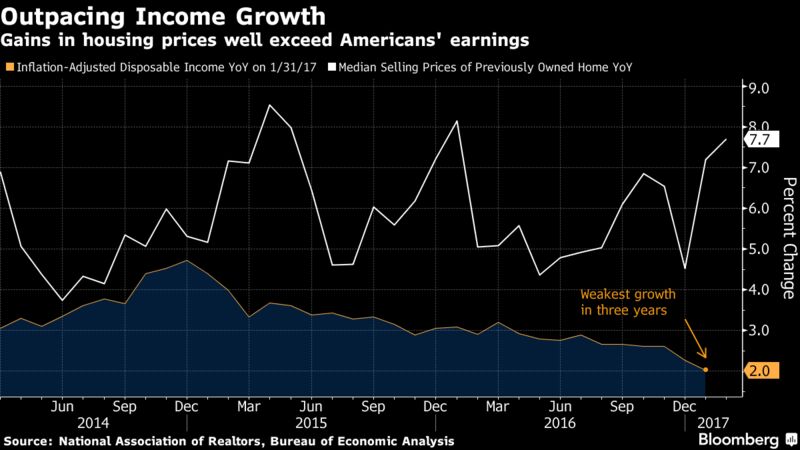

Great set of charts from Bloomberg on our housing inventory problem:

WTF

There’s Someone Out there For Everyone: A 32-year old man Texas was arrested for having sex with a fence. There are other things that he was doing to the fence that I’m not going to write here but are covered in great detail by my favorite website, The Smoking Gun. Drugs are bad.

Pigcasso: Morons are paying up to $2,000 for paintings by a pig.

See No Evil: A Canadian man with the last name is Grabher wants to use it on his license plate but the government thinks it’s too offensive.

Rekt: A man wearing baggy pants attempted to flee the scene of a robbery and ended up hanging by his feet from a spiked fence until the police arrested him. Someone took a picture and posted it to Facebook where it went viral. You really need to see the picture for this one.

Landmark Links – A candid look at the economy, real estate, and other things sometimes related.

Visit us at Landmarkcapitaladvisors.com