Must Read: (SOFR aka LIBOR’s chosen replacement) is a fucking mess (for those of you offended by swearing, that’s a technical term). LIBOR, the scandal-plagued borrowing index that has often been called the most important number in the world was at the center of a major financial scandal that lasted from the early 2000s to 2012 where brokers in some of the world’s largest financial institutions manipulated it for their own profit. The backstory to this scandal was memorialized in David Enrich’s excellent book, The Spider Network and the backlash has been fierce to say the least. The LIBOR fixing scandal has resulted in hearings, prosecutions and eventually a commitment from the Alternative Reference Rates Committee – convened by the Fed – to wind the LIBOR down by 2021 and start using something else as a reference rate for most of the world’s financial transactions – including a majority of real estate loans.

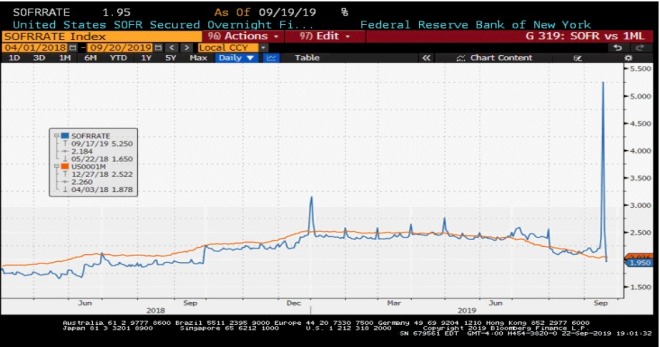

However, the trouble in doing away with and replacing “the world’s most important number” is that you have to find something that actually works, and in that regard, the events of the past week show that we are nowhere close. First things first, despite its myriad of issues, LIBOR has been remarkably stable over the years, with very little volatility – minus the a period in 2009 when the entire financial system was melting down. One could not say the same for the Secured Overnight Financing Rate (SOFR) which is the chosen replacement for LIBOR when (increasingly if) it is to be replaced. SOFR has been incredibly volatile, especially last week when it shot to the moon (SOFR went from 2.43% on Monday to 5.25% on Friday) after banks experienced a cash crunch due to some combination of settlement of a large Treasury auction, corporate tax bills coming due and and un-willingness to lend reserves due in part to more stringent reserve requirements. The result was that rates in the overnight lending market spiked, forcing the Federal Reserve to injection tens of billions of dollars in order to bring them back down to their targeted range. The irony here is pretty rich, given that what the Fed did to bring rates back to down is the textbook definition of manipulation which makes a logical person question what the point of kicking LIBOR to the curb is in the first place – especially when the Intercontinental Exchange (ICE) has already gone to great lengths to alter LIBOR’s inputs so its harder to game.

For a point of reference, I asked Rex Evans of Derivative Logic, who Landmark relies on rate caps to update one of my favorite charts that he put together a couple of months back. As you can see, LIBOR is remarkably stable over this time frame while SOFR jumps around like an EKG – up until the point that it went BOOM over the past couple of weeks (the orange line below is LIBOR and the blue line is SOFR):

Source: Derivative Logic

The incredibly volatile episode prompted the great Matt Levine of Bloomberg View to opine the following in his daily column:

But what if your mortgage was indexed to SOFR? Again, it’s not, but again the whole idea is that SOFR is supposed to be an atomic interest rate that you could build a whole financial system on top of. SOFR is a real rate, backed by lots of transactions by sophisticated participants in a deep and liquid market. It is hard to manipulate and, one would have thought, relatively immune from idiosyncratic weirdness, just due to the sheer size and centrality of the market. If your mortgage or your corporate loan was indexed to SOFR, your interest rate would go up when short-term interest rates broadly go up and down when short-term interest rates broadly go down, which is exactly the thing that you want from a reference rate.

SOFR is supposed to replace Libor, the London interbank offered rate, which is derived from a survey asking banks what rates they would have to pay for short-term unsecured borrowing. One problem with Libor is that it measures not only “interest rates” generally, but also bank credit quality; if big banks got in a lot of trouble, Libor could go up even as other short-term interest rates went down. Another problem with Libor is that the banks essentially get to make it up, so they used to answer the survey with a number that would make them look good, or make them money on derivatives, rather than a number that represented the true interest rate. SOFR is effectively a risk-free rate, and is based on lots of real hard-to-manipulate transactions, so it doesn’t have those problems.

Instead it has the problem of … corporate tax due dates … dealer balance-sheet constraints … I don’t know, that stuff. Like if your mortgage rate went up and you called your bank and said “why did my mortgage rate go up” and your bank said “well it turns out that a lot of corporate investors withdrew money from cash-management accounts to make quarterly tax payments at exactly the time that there was a big net Treasury issuance,” you would be very confused and annoyed. You might quite reasonably ask what any of that had to do with you, and why your interest rate was tied to such a strange set of random facts.

The reality observed over the past two weeks or so prove that SOFR is simply not ready for prime time with its massive swings based on seemingly obscure factors. Is LIBOR perfect? No. Did a bunch of crooks rig it to slice or add a few basis points and put money in their pocket? Yes, and they ultimately paid the price when caught. However it does beg the question: what would you want your mortgage or a business loan tied to? I know my answer and it is the deeply flawed, yet stable LIBOR. Sometimes you’re just better off sticking with the devil that you know than moving to something new that puts the entire global financial system in harms way.

Economy

Rebound? Stronger than expected recent economic data means that the case for further rate cuts is no longer strong.

Cash For Clunkers: The quickly-rising cost of auto maintenance is pushing consumers to buy new cars.

Commercial

Behind the Curtain: A purportedly grass roots campaign to take down Amazon is actually being funded by its biggest competitors.

Shots Fired: Professor Scott Galloway goes in hard on WeWork and lays out the case that its a fraud while making the following predictions:

-

In the next 30 days, a series of explosive investigative journalism pieces will document breathtaking malfeasance at We.

-

In the next 60 days, a state attorney general, SEC, or other regulatory body will launch a formal investigations into We.

-

Over the next 12 months, SoftBank’s Vision Fund will be shuttered.

He’s been out in front of this story for months so it will be interesting to see if it continues. See Also: Pressure is mounting from board members who want to give Adam Neumann the boot. Consider it a community-adjusted exit.

Off the Charts: Retail bankruptcies / store closures have now accelerated past where they were in 2018.

Added Risk: The Federal Reserve is now sounding the alarm that the proliferation of co-working tenants could lead to higher instances of default in the office market when the next recession hits. (h/t Stone James)

Residential

Asking for Trouble: A small amount of rent control may not roil markets too much but too much – as seen in New York – can cause a market to crater. See Also: Cap rates are already rising in markets with stringent new rent control laws.

Retaliation: Treasury is planning to restrict GSE multifamily lending in markets with rent control.

Profiles

The Truth is Out There: How a PE backed buyout of baseball maker Rawlings by Major League Baseball is adding fuel to the juiced ball conspiracy theory. (h/t Dave Kidder)

This Has To Be The Top: Flipping sneakers for a profit is now a thing.

Myth Busters: Private markets are not nearly as good at price discovery as public markets, no matter what VC’s and founders say – this years class of unicorn IPOs is proof.

Chart of the Day

Source: Wall Street Journal

WTF

Biological Weapon: A Scottish man was arrested and charged for farting repeatedly during a strip search. No word as to whether or not Taco Bell was involved.

Tapping Out: A woman bit a camel’s testicle to free herself after it sat on her because Louisiana. If you need any more evidence that this happened in the south, it was at a truck stop. (h/t Seth Barrett)

Getaway Buggy: Two Amish men escaped police after being pulled over for drinking and driving their horse and buggy.

Yanked: The Patriots cut troubled wide receiver Antonio Brown just one week after signing him. Team owner Robert Kraft said that Brown played well but rubbed him the wrong way.

Landmark Links – A candid look at the economy, real estate, and other things sometimes related.

Visit us at Landmarkcapitaladvisors.com